Discover Secrets To Financial Success

"Navarro Net Worth" refers to the total value of the assets and income of the individual known as "Navarro." It encompasses all financial holdings, including cash, investments, real estate, and other valuable assets.

Understanding an individual's net worth provides valuable insights into their financial health, investment strategies, and overall economic standing. It can be a key indicator of financial success and plays a crucial role in determining factors such as creditworthiness, investment opportunities, and overall financial planning.

The net worth of an individual can fluctuate over time due to changes in the value of their assets, income, and liabilities. Regular monitoring and assessment of net worth are essential for effective financial management and decision-making.

Navarro Net Worth

Understanding the various dimensions of "Navarro Net Worth" provides valuable insights into an individual's financial standing and economic well-being. Key aspects to consider include:

- Assets: Cash, investments, real estate, and valuable possessions.

- Income: Earnings from employment, investments, and other sources.

- Investments: Stocks, bonds, mutual funds, and other financial instruments.

- Liabilities: Debts, loans, and other financial obligations.

- Financial Management: Strategies employed to optimize financial resources.

- Tax Implications: Impact of taxes on net worth and financial planning.

- Estate Planning: Arrangements to manage and distribute assets after death.

- Economic Indicators: Net worth as a reflection of overall economic conditions.

- Personal Circumstances: Age, career, family situation, and lifestyle factors.

These aspects are interconnected and influence an individual's overall financial well-being. For example, managing assets effectively can increase net worth, while high levels of debt can reduce it. Understanding the interplay between these factors is crucial for effective financial decision-making.

Assets

Assets constitute a fundamental component of "Navarro Net Worth," significantly influencing an individual's overall financial standing. Assets encompass various forms of wealth, including:

- Cash: Physical currency and cash equivalents, providing immediate liquidity.

- Investments: Stocks, bonds, mutual funds, and other financial instruments, offering potential for growth and income generation.

- Real Estate: Land, buildings, and other property, providing both potential appreciation and rental income.

- Valuable Possessions: Collectibles, artwork, jewelry, and other items of significant monetary or sentimental value.

The composition and value of these assets directly impact Navarro's net worth. For instance, a high proportion of appreciating assets can contribute to a growing net worth, while substantial liabilities can diminish it. Effective management of assets, including diversification, risk assessment, and strategic investments, is crucial for preserving and enhancing net worth over time.

Income

Income plays a vital role in shaping "Navarro Net Worth" as it represents the flow of funds that contribute to the accumulation of wealth. Navarro's income can stem from various sources, including:

- Employment: Wages, salaries, bonuses, and other forms of compensation earned through employment.

- Investments: Dividends, interest, and capital gains from investments in stocks, bonds, and other financial instruments.

- Other Sources: Rental income, royalties, business profits, and other income streams.

Understanding the composition and stability of Navarro's income is crucial in assessing his overall financial health. A steady and diversified income stream can contribute to a growing net worth, while relying heavily on a single income source may increase financial vulnerability. Effective income management, including budgeting, saving, and investing, is essential for maximizing the impact of income on net worth.

Investments

Investments play a pivotal role in shaping "Navarro Net Worth" as they represent a substantial portion of an individual's assets and can significantly influence overall wealth accumulation. Navarro's investments encompass a range of financial instruments, including:

- Stocks: Equity shares in publicly traded companies, offering potential for capital appreciation and dividends.

- Bonds: Loan agreements with governments or corporations, providing fixed income payments.

- Mutual Funds: Professionally managed portfolios of stocks and bonds, offering diversification and accessibility to various asset classes.

- Other Financial Instruments: Options, futures, and other derivatives, providing opportunities for advanced investment strategies.

The composition and performance of Navarro's investments directly impact his net worth. A well-diversified portfolio, including a mix of asset classes and risk levels, can contribute to a growing net worth over time. Conversely, concentrated investments or exposure to volatile markets may lead to fluctuations in net worth. Effective investment management, including regular monitoring, rebalancing, and strategic adjustments, is crucial for optimizing the impact of investments on net worth.

Liabilities

Liabilities represent a crucial component of "Navarro Net Worth," as they directly impact the overall financial standing and solvency of an individual. Liabilities encompass various forms of debt, including:

- Debts: Amounts owed to creditors, such as personal loans, credit card balances, and mortgages.

- Loans: Funds borrowed from financial institutions or individuals, typically with a specified repayment schedule and interest.

- Other Financial Obligations: Legal or contractual commitments that require future payments, such as child support, alimony, or tax liabilities.

Understanding the composition and extent of Navarro's liabilities is essential in assessing his financial health. High levels of debt can significantly reduce net worth and strain financial resources, while manageable liabilities may be necessary for certain financial endeavors, such as homeownership or business investments.

Effective management of liabilities, including timely payments, debt consolidation, and strategic refinancing, is crucial for minimizing their impact on net worth. Failure to manage liabilities effectively can lead to financial distress, damage to credit scores, and legal consequences.

Financial Management

Effective financial management is a cornerstone of "Navarro Net Worth," enabling individuals to optimize their financial resources and maximize wealth accumulation. It encompasses a range of strategies designed to enhance financial well-being, including:

- Budgeting: Creating a plan for income and expenses, ensuring responsible spending and efficient use of resources.

- Saving: Setting aside a portion of income for future needs, emergencies, or long-term financial goals.

- Investing: Allocating funds into various investment vehicles to generate income, grow wealth, and meet financial objectives.

- Debt Management: Minimizing interest payments, reducing debt balances, and maintaining a healthy credit score.

- Tax Planning: Optimizing tax strategies to reduce liabilities and maximize after-tax income.

For example, Navarro may employ a budgeting strategy to track his income and expenses, ensuring that his spending aligns with his financial goals. By prioritizing essential expenses, reducing unnecessary spending, and identifying areas for savings, Navarro can allocate more funds towards investments and debt reduction.

Effective financial management allows Navarro to make informed decisions about his financial future, navigate economic challenges, and achieve his long-term financial aspirations. It contributes directly to the growth and sustainability of "Navarro Net Worth." Without proper financial management, even individuals with substantial income may struggle to accumulate wealth and secure their financial well-being.

Tax Implications

Taxes play a significant role in shaping "Navarro Net Worth" and financial planning. Understanding the impact of taxes is crucial for optimizing financial strategies and achieving long-term financial goals.

- Taxable Income: Determining Navarro's taxable income involves understanding various sources of income, deductions, and exemptions. Taxable income directly affects the amount of income tax owed, impacting net worth.

- Tax Rates: Applicable tax rates, such as income tax brackets and capital gains tax rates, influence the portion of income and investment returns that are subject to taxation. Higher tax rates can reduce net worth, while lower tax rates can contribute to its growth.

- Tax-Advantaged Accounts: Utilizing tax-advantaged accounts, such as 401(k) plans and IRAs, can minimize current tax liabilities and allow investments to grow tax-deferred or tax-free. This can significantly enhance net worth over time.

- Estate Planning: Tax implications extend beyond Navarro's lifetime through estate planning. Understanding estate taxes and implementing appropriate strategies can help preserve and distribute net worth to heirs while minimizing tax burdens.

Effective tax planning involves considering the interplay between income, investments, and tax laws. By proactively addressing tax implications, Navarro can optimize his financial decisions, reduce tax liabilities, and maximize the growth of his net worth.

Estate Planning

Estate planning plays a vital role in safeguarding and distributing "navarro net worth" after an individual's passing. It encompasses legal and financial arrangements designed to manage and distribute assets in accordance with the individual's wishes, ensuring an orderly and efficient transfer of wealth.

One crucial aspect of estate planning is the appointment of an executor, responsible for administering the estate according to the deceased's instructions. This includes managing assets, paying debts and taxes, and distributing inheritances to designated beneficiaries.

Effective estate planning can minimize estate taxes and other expenses, maximizing the net worth passed on to heirs. It also provides a framework for distributing assets according to the individual's wishes, avoiding potential disputes or legal challenges.

In the context of "navarro net worth," estate planning ensures that Navarro's wealth is managed and distributed in a manner that aligns with his financial goals and personal values. By proactively addressing estate planning, Navarro can protect his net worth, minimize tax burdens, and ensure a smooth and effective transfer of assets to his intended beneficiaries.

Economic Indicators

Fluctuations in "navarro net worth" can provide valuable insights into broader economic trends and overall economic conditions. Here are several key facets to consider:

- Consumer Confidence: Navarro's net worth can be influenced by consumer confidence, which affects spending patterns and investment decisions. When consumers are optimistic about the economy, they are more likely to make purchases and invest, potentially increasing Navarro's net worth through increased sales or investment returns.

- Interest Rates: Changes in interest rates can impact Navarro's net worth through borrowing costs and investment returns. Rising interest rates may increase the cost of debt, reducing Navarro's net worth if he has significant liabilities. Conversely, higher interest rates can also lead to higher returns on investments, potentially boosting his net worth.

- Employment and Wages: Economic conditions directly affect employment rates and wage growth. If the economy is performing well, Navarro's net worth may increase due to higher wages or additional income streams from employment.

- Inflation and Cost of Living: Inflation and rising cost of living can erode the purchasing power of Navarro's net worth. If inflation outpaces the growth of his assets and income, his net worth may decline in real terms.

By understanding the relationship between these economic indicators and "navarro net worth," we can gain a more comprehensive perspective on the factors that influence his financial well-being and the overall health of the economy.

Personal Circumstances

The intricate tapestry of "navarro net worth" is profoundly intertwined with an individual's personal circumstances, encompassing age, career, family situation, and lifestyle factors. These factors exert a multifaceted influence on financial well-being and the accumulation of wealth.

Age, for instance, plays a pivotal role in shaping net worth. In the early stages of a career, individuals typically have lower incomes and fewer assets, resulting in a smaller net worth. As they progress in their careers and experience salary growth, their net worth tends to increase. However, as individuals approach retirement, their income may decrease, and their net worth may stabilize or even decline if they draw down on their savings.

Career choice is another significant factor that influences net worth. Individuals working in high-paying industries, such as finance or technology, often have higher net worths compared to those in lower-paying fields. Additionally, career stability and opportunities for advancement can positively impact net worth over time.

Family situation also bears considerable weight in determining net worth. Individuals with spouses or partners may benefit from combined incomes and shared expenses, potentially leading to a higher net worth. Conversely, single individuals or those with dependents may face additional financial responsibilities, impacting their ability to accumulate wealth.

Lifestyle factors, including spending habits and financial discipline, play a crucial role in shaping net worth. Individuals who live within their means, prioritize saving, and make wise investment decisions are more likely to accumulate wealth over time. In contrast, those who engage in excessive spending or lack financial planning may find it challenging to grow their net worth.

Understanding the connection between personal circumstances and "navarro net worth" is essential for developing effective financial strategies. By considering these factors, individuals can make informed decisions about career choices, financial planning, and lifestyle habits, ultimately optimizing their path towards financial well-being.

Frequently Asked Questions (FAQs) on "Navarro Net Worth"

This section addresses common inquiries and misconceptions surrounding the concept of "navarro net worth," providing concise and informative answers.

Question 1: What is "navarro net worth"?"Navarro net worth" refers to the total value of an individual named Navarro's assets, income, and investments, minus their liabilities or debts.

Question 2: Why is "navarro net worth" important?Understanding "navarro net worth" provides insights into an individual's financial well-being, creditworthiness, and overall economic standing.

Question 3: What factors influence "navarro net worth"?"Navarro net worth" is influenced by various factors, including assets, income, liabilities, financial management, tax implications, estate planning, economic indicators, and personal circumstances.

Question 4: How can I increase my "navarro net worth"?To increase "navarro net worth," focus on asset accumulation, income growth, liability reduction, effective financial management, tax optimization, and estate planning.

Question 5: What are some common misconceptions about "navarro net worth"?A common misconception is that "navarro net worth" solely represents an individual's wealth. In reality, it encompasses both assets and liabilities.

Question 6: How can "navarro net worth" impact my financial future?"Navarro net worth" can significantly impact an individual's financial future, influencing access to credit, investment opportunities, and overall financial security.

In conclusion, "navarro net worth" is a multifaceted concept that encompasses various financial aspects. Understanding and managing these factors can contribute to sound financial decision-making and long-term economic well-being.

Transition to the next article section: Exploring the complexities of "navarro net worth" reveals its significance in assessing an individual's financial standing and strategic financial planning.

Tips to Enhance "Navarro Net Worth"

Effective financial management is crucial for optimizing "Navarro Net Worth." Here are several valuable tips to consider:

Tip 1: Prioritize Asset Accumulation

Focus on acquiring assets that have the potential to appreciate in value over time. This includes investments in real estate, stocks, bonds, and other financial instruments.

Tip 2: Maximize Income Streams

Explore opportunities to increase income through career advancement, starting a side hustle, or investing in passive income sources. Diversifying income streams can enhance financial stability and contribute to net worth growth.

Tip 3: Manage Liabilities Strategically

Keep liabilities under control by minimizing unnecessary debt and negotiating favorable terms on loans. Prioritize paying off high-interest debts to reduce financial burdens.

Tip 4: Adopt Effective Financial Management Practices

Implement budgeting techniques to track expenses and identify areas for savings. Regularly monitor financial performance and make adjustments as needed to optimize resource allocation.

Tip 5: Optimize Tax Strategies

Understand tax implications and explore legal tax-saving strategies. Utilize tax-advantaged accounts, such as 401(k) plans and IRAs, to reduce tax liabilities and maximize investment returns.

Tip 6: Plan for the Future

Develop an estate plan to ensure the smooth transfer of assets after your passing. Consider estate taxes and appoint an executor to administer your estate according to your wishes.

Tip 7: Seek Professional Advice

Consult with financial advisors, tax professionals, and estate planners to gain expert insights and guidance. They can assist in developing a comprehensive financial plan tailored to your specific needs and goals.

By implementing these tips, individuals can work towards enhancing their "Navarro Net Worth," securing financial well-being, and achieving long-term financial success.

Transition to the conclusion: Understanding the nuances of "Navarro Net Worth" and applying these strategies can empower individuals to make informed financial decisions and build a solid foundation for their economic future.

Conclusion

In exploring the complexities of "Navarro Net Worth," we have uncovered its significance as a measure of financial well-being and a foundation for strategic financial planning. This in-depth analysis has illuminated the interplay between assets, income, liabilities, and various other factors that shape an individual's net worth.

Understanding the nuances of "Navarro Net Worth" empowers individuals to make informed financial decisions, optimize their financial strategies, and secure their economic future. By adopting the recommended tips and seeking professional guidance when necessary, individuals can work towards enhancing their net worth, achieving financial independence, and fulfilling their long-term financial aspirations.

Unveiling The Political Dynamics: Tucker Carlson's Wife's Political Affiliation

Unveil The World Of Iris Hanbury: Discoveries And Insights Await

Uncover The Truth: The Landmark "Jeanie Clarke Children" Case

Who is Ana Navarro Husband? Bio, Net Worth 2023, Age

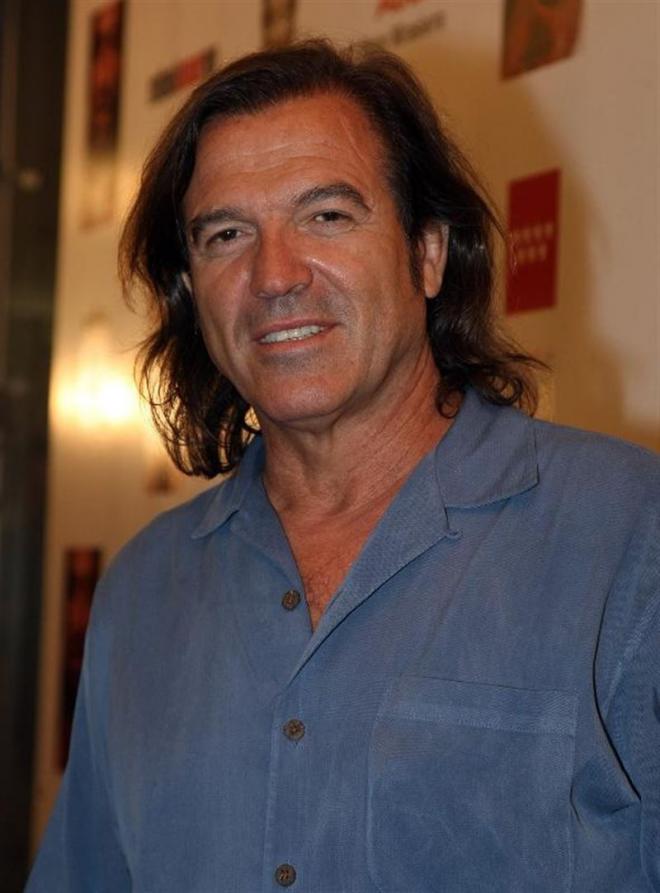

Pepe Navarro Net Worth & Biography 2022 Stunning Facts You Need To Know

Peter Navarro Net Worth (Updated 2022) Net Worth Informant

ncG1vNJzZmidqKW%2Fpr%2FIr5xnq2NjwrR51p6qrWViY66urdmopZqvo2OwsLmOp5ivmaKnvG66xK1ksKeiqbVvtNOmow%3D%3D